|

Enjoy your reading !

THE HONOTEL TEAM

🔎 THE QUARTER UNDER THE MICROSCOPE

A FIRST QUARTER BOOSTED BY THE HIGH-END SEGMENT

|

|

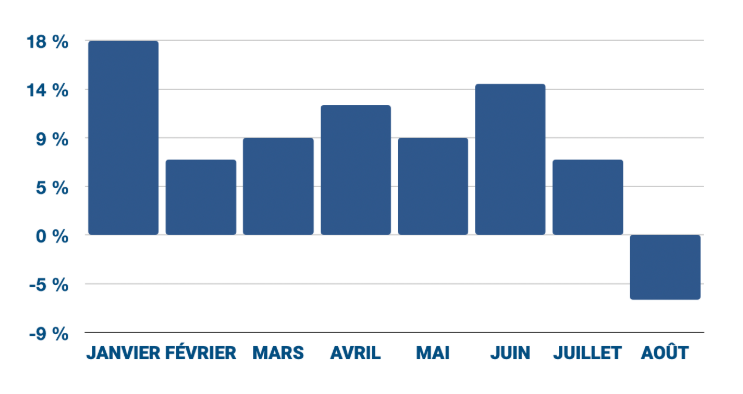

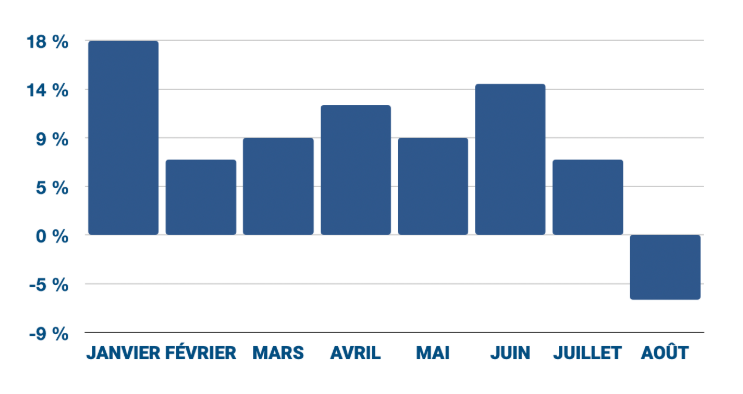

At the start of 2025, the French hotel industry is enjoying a welcome breath of fresh air. With RevPAR up +4.2% in January, followed by +2.2% in February, the sector is performing well despite a still uncertain economic climate.

Momentum driven almost exclusively by the top end of the market

At the end of February, RevPAR for French hotels was up 2.2%. The driving forces behind this growth are cities with strong leisure appeal, capable of attracting an international clientele, particularly from North America, which has responded, benefiting from a favorable exchange rate and still attracted by France’s image, boosted by the Olympic Games.

A two-speed sector

In Paris, luxury establishments capitalize on an international clientele with high purchasing power, seduced by a destination that has once again become iconic. In this destination, the gap is widening: accessible establishments are recording a modest 3% increase in RevPAR, while luxury establishments are posting growth of over 10%. In Nice, the market was up 5.1% at the end of February, also driven by mid-range and high-end hotels. In the regions, on the other hand, business-oriented cities are already suffering the effects of sluggish economic growth and a sluggish construction sector (Lille -6%, Bordeaux -4%, Nantes -10%, Toulouse -7%). Cities that have succeeded in developing leisure tourism (Marseille -0.5%, Strasbourg +4%) and/or major events (Lyon +24% thanks to the SIRHA) are holding up well.

The first quarter thus reveals a now-familiar scenario: that of a two-speed sector. Business is picking up, but at the cost of a growing polarization between the experience hotel sector, which is in good shape, and the necessity hotel sector, which is struggling to recover.

Source figures : MKG

|

© Le Negresco Nice / Nick Page – Unsplash

💬 OUR CONVICTION

|

|

A resilient hotel industry in a changing world

“After a first quarter buoyed by the upscale leisure segment, investors are now legitimately questioning the sustainability of the international tourist flows that support the hotel industry, particularly Americans. Geopolitics influence travel choices, as demonstrated by France’s strong appeal to Canadian customers (+27% arrivals in Paris forecast for Q2).

At this stage, flows from the USA to France remain buoyant (+11% arrivals in Paris and +11% in Nice in Q2), but a turning point seems to be emerging by the end of 2025. Volumes are still low, and trends will have to be monitored over time”.

Gaétan LE POGAM, Associate Director, Honotel

|

Air arrivals at Paris airports – source : Forwards Keys

📜 LARGE FORMAT

|

“By 2025, we anticipate a 15% increase in investment volumes in the EMEA region”

|

|

Laura Ben-Ibgui, Executive Vice President and Head of France – hotels capital markets at JLL, gives her forecasts for the coming months for the hotel investment market, in light of the sector’s 2024 balance sheet and current dynamics.

Check-in : What outlook do you expect for the hotel market in 2025 ?

Laura Ben-Ibgui : After a mixed year for operators, 2025 looks set to be a dynamic year. On an EMEA scale, JLL anticipates a 15% increase in volumes invested, and France should benefit from this favorable trend. Several calls for tender are already underway, particularly in the entry-level sector. In a persistently tense economic climate, these deals illustrate the desire of many players to find new financial partners or explore strategic opportunities for growth.

Should 2025 make us forget 2024 ?

I’d be more nuanced. In 2024, the French hotel industry continued to attract significant capital, with almost €2.5 billion in transactions – excluding the consolidation operation between Covivio and AccorInvest (€786 million). Of this total, 92% concerned single assets, with portfolios virtually absent (8%). Paris alone accounted for two-thirds of the volume invested. The majority of these structuring transactions are led by foreign funds, notably from Asia. Between 2023 and 2024, international capital almost doubled in the French hotel sector, rising from 32% to 56% of total investment volume.

Unsurprisingly, the vast majority of transactions last year were for business premises and goodwill…

This situation can be explained by a profoundly transformed interest-rate universe, more limited inflows, and institutional investors more focused on asset management than investment. A final lesson: in the 4-star + and 5-star segments, the valuation cap of over one million euros per key is becoming the norm.

How does France compare with other European countries ?

France remains in the top 3 of European countries where the most capital is exchanged in the hotel industry. While historically this podium was made up of the UK, Germany and France before Covid, today the German hotel market has given way to Spain. The UK remains in first place, driven by private equity funds with shorter holding periods than wealthy owners.

Why is this alternative segment so robust?

|

While the office sector is experiencing a sharp downturn (€4.7 billion invested in 2024), logistics is gaining the upper hand (€5 billion), and the hotel sector is holding its own with 11% of overall investment volume. This resilience is based on several factors: a rapid post-Covid recovery, sustained demand despite geopolitical tensions, and local regulatory tightening towards Airbnb in several European capitals, which is boosting the attractiveness of hotels. In addition, private investors and family offices are benefiting from attractive tax levers in this segment, enabling them to diversify their assets beyond offices.

Laura Ben-Ibgui © D.R

💬 OUR CONVICTION

|

|

A safe haven for investors

“While the tourism market is polarizing under the impact of international politics, we remain convinced that the hotel business remains an investment with solid fundamentals.

The midscale positioning of Honotel’s investments offers greater protection against market fluctuations thanks to a diversified customer mix (national/international and leisure/business).

Investing through a fund rather than in a direct asset also makes it possible to limit risk by investing in several French and European destinations.”

Suzanne TODD, Director, Hôtel Investissement Capital (HIC)

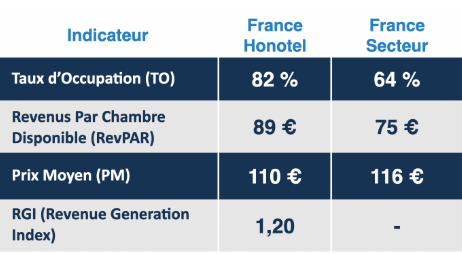

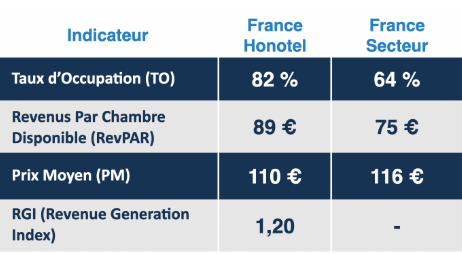

OUR KEY FIGURES FOR THE QUARTER

|

|