Hospitality investment

& management

A key player

With its strong background in the hotel trade and investment expertise, Honotel is a key player in the hospitality sector in France and now has ambitions to develop further into Europe. Its value creation model is based on proven expertise with its clients, leading institutional investors and private wealth.

As a committed and responsible company, Honotel has implemented a Corporate Social Responsibility programme based on two fundamental principles: well-being at work and respect for the environment.

As an agile and innovative company, Honotel is constantly investing in digitisation to improve the experience of hotel guests and the productivity of employees.

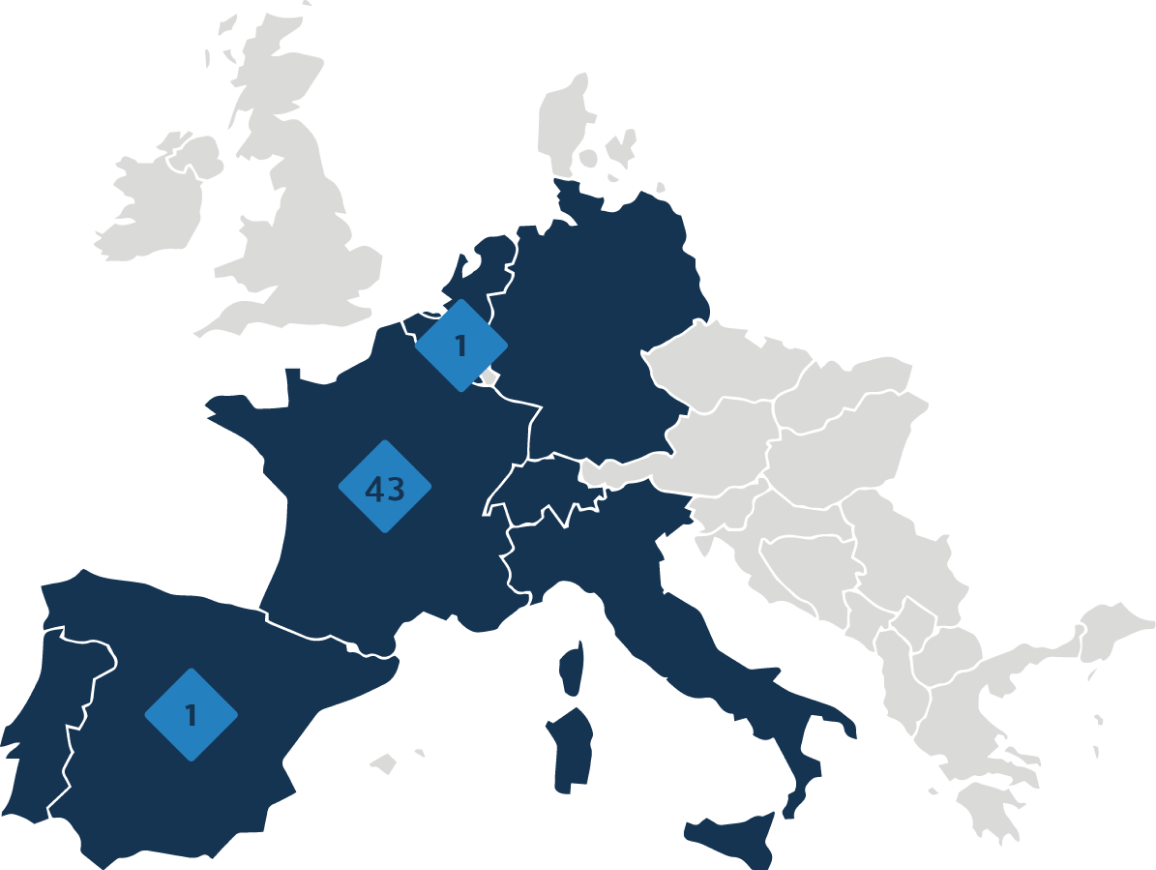

European presence

The Group operates in 8 European countries, with a portfolio of 146 assets, positioned in the economic, midscale and upscale segments in Europe, with an asset value of €1.2 billion.

Board of Directors

- Co-founder

- MBA Hospitality Mgt ESSEC / Cornell

- Member of the Strategic Board

- Joined Honotel in 2011

- ESC Toulouse

- Member of the Strategic Board

- Joined Honotel in 2004

- DECF

- Member of the Strategic Board

- Joined Honotel in 2008

- Master’s Degree IAE Lyon 3

- Member of the Strategic Board

- Joined Honotel in 2017

- ESSEC / Sciences Po Paris

- Member of the Strategic Board

Executive Committee

- Joined Honotel in 2019

- ESCP Europe

- Joined Honotel in 2014

- ESC Nancy

- Joined Honotel in 2015

- Master 2 Paris I Panthéon Sorbonne

The group’s general management has surrounded itself with 25 experts whose high value-added skills enable it to respond perfectly to the new challenges of the market.

Value-creating repositioning for clients and for future asset valuation

More than 20 years of performance

in the hospitality industry

After having successfully managed the French subsidiary of the Best Western hotel franchise group for four years, Antoine de Bouchony and Laurent Lapouille joined forces in hotel investment operations.

Together, they ran Paris-Honotel and took charge of the asset management and operational management of a portfolio of 3 and 4 star hotels in Paris which they expanded as opportunities arose.

The portfolio of 15 two and three star hotels in Paris under the Timotel banner (850 rooms) was sold to the LFPI Group. It was acquired in 2003 in association with Lazard Bank via an LBO with structured financing provided by Crédit Agricole Corporate & Investment Bank (CA CIB).

The sale was based on an EBITDA that had been doubled through a mixed strategy of asset optimisation and business development. The Timotel portfolio was managed on behalf of LFPI until 2008.

In partnership with Chequers Capital, Laurent Lapouille and Antoine de Bouchony supported the creation of the mutual fund FCPR CHF. Between 2008 and 2012, they built the fund’s portfolio with the acquisition of 19 three and four star hotels in France (920 rooms). They provided asset management and operational management.

From 2014 onwards, the managers organised and steered the disposals. They were carried out in batches over 36 months.

Hôtel Investissement Capital is an AMF-approved portfolio management company (SGP) (GP-15000008) and is engaged in collective investment management. Its founders chose Olivier Perret du Cray as President. Perret du Cray is a former Senior Advisor to the Property Department of Crédit Agricole Corporate & Investment Bank (CA CIB).

With the Happyculture Collection label, the client experience is placed at the heart of the hotels’ operational strategy. Its success is based on enthusiastic and expert hosts, stylish venues, quality service, free high-speed wifi, opportunities for sharing, small mobile services, etc..

SGP Hôtel Investissement Capital has already raised €42m for its new fund, FPCI Cap Hospitality, half of which from institutional investors. This fund, dedicated to short and medium-stay commercial accommodation, has acquired 5 hotels in France.